Mexican e-commerce market accounts for 26% of Latin America’s e-commerce sector. By 2025, the country’s e-commerce user base is projected to exceed 80 million, demonstrating robust growth potential.

Surge in Mexican E-commerce Market

Latin American e-commerce platform Tiendanube reveals that in 2024, the sales revenue of online stores on its platform surged by 71%. Order volume was increased by 55% and average order value rising by 10%.

In terms of category growth trends, health & beauty led the way with a 17% increase. Pet supplies, gifts, and toys also saw growth, though their shares remained relatively small. Notably, the categories with the highest average order values were equipment & machinery ($5,447) and construction & industrial ($3,528).

Meanwhile, promotional campaigns remain a key driver of e-commerce growth, with major shopping festivals such as Hot Sale and El Buen Fin playing a significant role—sales surged by 42% and 88% during these events, respectively. Merchants widely adopted strategies like discounts, buy-one-get-one offers, and free shipping to boost sales and attract more consumers.

Tiendanube noted that despite Mexico’s rapid e-commerce growth, barriers to entry still need to be lowered to encourage more businesses to join the digital marketplace. Currently, only 2% of the country’s 5.5 million formal SMEs operate online stores, compared to 6% in Brazil and 13% in Argentina.

Key Drivers of Mexican E-commerce

Market Expansion

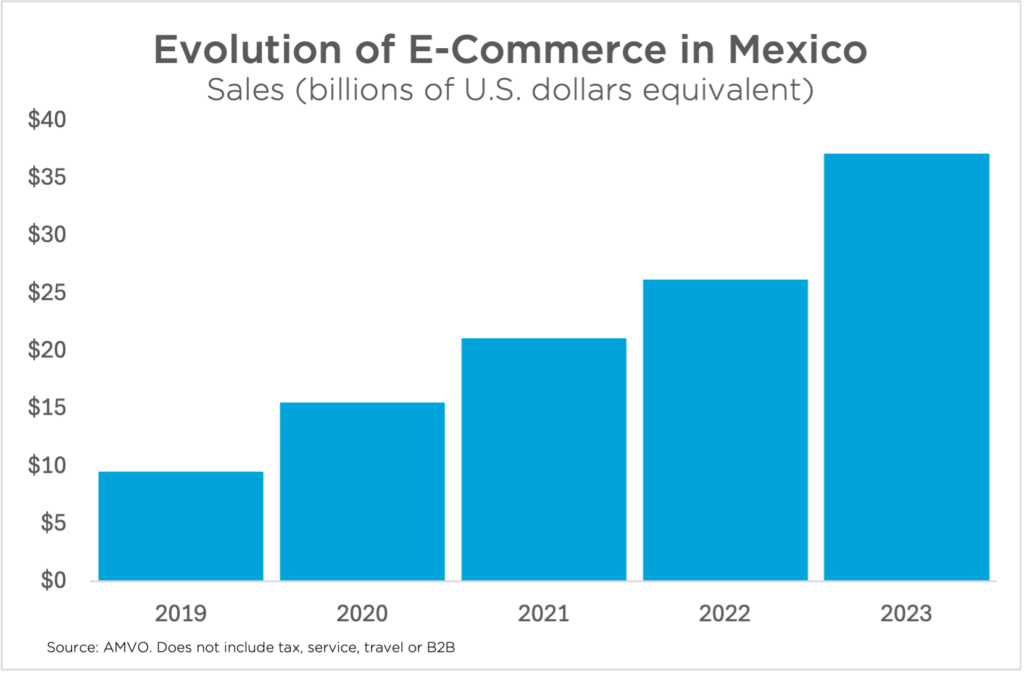

Beyond headline figures, broader industry reports confirm the strong upward trajectory. For instance, the Mexican Association of Online Sales (AMVO) reported a significant 24% year-over-year growth in the first quarter of 2024. Projections indicate sustained momentum, predicting a compound annual growth rate (CAGR) of 11.71% for retail e-commerce sales between 2024 and 2028. Other market projections are even more bullish, suggesting Mexico could see around 33% growth in its e-commerce market by 2026 compared to 2023 levels. This can be expected to reach values like US$61.4 billion in 2024 according to some reports.

The Rise of the Digital Consumers

This growth is fundamentally powered by people. We’re seeing a significant increase in digital adoption. Major players witnessed a 16% year-over-year increase in unique buyers, reaching 53.5 million in early 2024. It’s not just more people shopping online. The average age has increased to nearly 39 years old in 2024. Crucially, e-commerce is becoming more inclusive. Furthermore, customer satisfaction remains high, with reports suggesting 71% of Mexican online shoppers are satisfied with their experience, encouraging repeat purchases and further adoption.

M-Commerce: Fueling the Fire

Mobile commerce, or M-commerce, continues to be a critical catalyst. While data from 2021 already showed mobile devices accounting for nearly 38% of e-commerce sales, its importance has only grown. Given Mexico’s high smartphone penetration rates, optimizing the shopping experience for mobile devices is no longer optional. The convenience of browsing, comparing, and purchasing via smartphones aligns perfectly with modern consumer lifestyles, making M-commerce a cornerstone of the Mexican e-commerce expansion.

Growth in Categories

Marketplaces play a huge role. Mercado Libre’s reported 71% surge in net income for Q1 2024, significantly driven by its operations in Mexico and Brazil. Their robust logistics, payment solutions, and vast product selection create a trusted ecosystem for buyers and sellers. We’re also seeing specific product categories driving growth. Notably, home appliances saw a remarkable 46% growth in early 2024, alongside strong performance in electronics like computers, tablets, and mobile phones. This diversification shows e-commerce penetrating deeper into various retail segments.

Trends and Opportunities in 2025

The current 71% revenue surge highlighted by some reports is indicative of a larger, sustained transformation. Looking ahead, the potential remains immense. Projections estimate that the digital buyer penetration rate could reach over 90% by 2029. E-commerce is already contributing around 6% to the national GDP, a figure likely to climb.

For businesses, this means adapting quickly. Key focus areas should include:

- Customer Experience: With high satisfaction rates setting the bar, delivering seamless, trustworthy, and efficient online shopping experiences is paramount.

- Mobile-First: Ensuring websites and checkout processes are fully optimized for mobile devices is critical.

- Data: Understanding the evolving consumer profile and category trends allows for targeted marketing and inventory management.

- Marketplace Partnerships: Collaborating with major platforms like Mercado Libre or Amazon can provide immediate access to a large customer base.

In conclusion, the narrative surrounding Mexican E-commerce Explodes: 71% Revenue Surge in 2024 accurately reflects the dynamic and rapidly expanding digital market in Mexico. Driven by increasing digital adoption, evolving consumer demographics, the critical role of M-commerce, and strong category growth, the sector presents significant opportunities. As a Marketing Manager, my advice to businesses looking at the Mexican market is clear: the time to invest in and prioritize your digital strategy is now. Understanding these trends and adapting accordingly will be key to capturing growth in this vibrant and promising e-commerce landscape.